Business Advisory

Our success is only to the degree our clients enjoy success which typically is measured by sales growth, increased cash flow, net worth growth and peace of mind.

We are focused on helping small business clients start and grow their ventures, develop net worth and the retain or transfer their accumulated wealth.

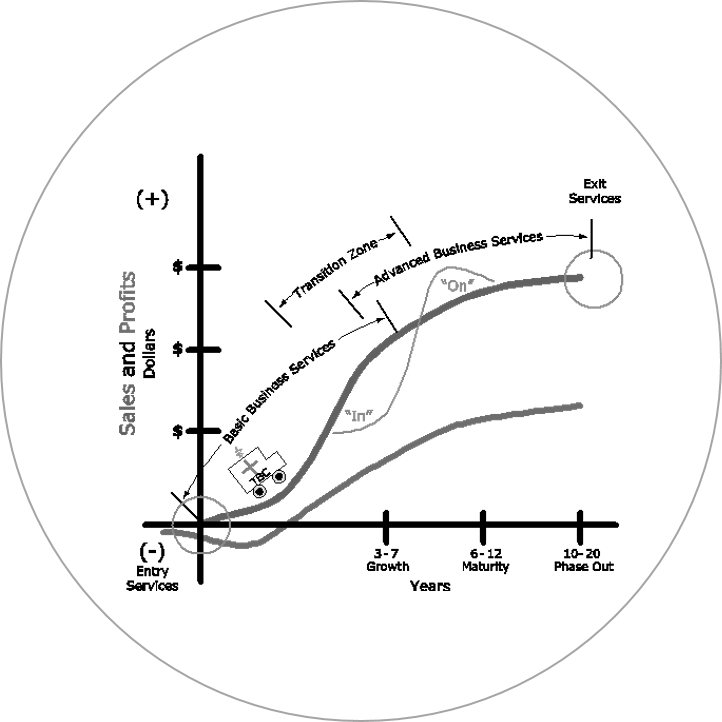

Simplified, TBC provides a combination of custom and proprietary advisory services to support a client from the time a concept for a venture is defined until a phase out is completed which may be many years later.

Because of the complexity of the challenges typically encountered by small business owners and the length of time required from start up to phase out, TBC nurtures its relationships with clients and offers them a broad range of both custom business advisory services and proprietary care products.

On a continuing basis we strive to be as our name implies, that is, Total Business Care to our many clients.

The strength of our firm resides in its professionals and the processes that have been developed by them over many years of experience. Our staff both directs their energies to what clients want as well as what clients will need. As a result of this process ready condition, they are prepared to offer and provide a broad range of general management and financial services that clients require on an immediate basis as well as those they will want as they prosper.

Our business advisory services which address general management needs are uniquely designed for the specific conditions of each client and include the following:

New Business Start Up

Franchise Development

Franchise Purchase

Business Planning

Marketing Management

Operational Analysis

Financial Management

Human Resources

Advisory Board Formation

Management Succession

Sales of Business

Purchase of Business

Management Training

Bankruptcy Support

“Total Business Care’s Road To Business Success seminar was fun and informative. Bob is always happy to share insights from his many decades of business management consulting experience. Additionally, his tax and finance specialists are an invaluable resource.”

TBC Services

By applying our accounting and training services, TBC evaluates, develops, and implements a plan to assist business clients start, grow, and maintain your venture.

TBC Care Product

QuickCare℠ provides accounting assistance to integrate QuickBooks or other software with your business and offers service packages with on-site and internet support.

Professional Certification

Our Accounting Team members have acquired certifications in the use of QuickBooks software to become Intuit ProAdvisors.

TBC Care Product

Financial Care℠ is a comprehensive package of services to improve cash flow and profits through analysis, expertise and review by a senior professional.

TBC Services

Increase your cash position and strengthen your financial stability through our income tax services.

TBC Care Product

Tax Care℠ provides a complete range of services which address income tax needs of individuals, partnerships, limited liability companies and corporations.

Certified Professionals

Total Business Care has Tax Professionals that are Enrolled Agents through the National Association of Enrolled Agents and licensed tax preparers.

TBC Services

We work with you to evaluate and identify the best way to select and manage a business through our Entity Administration services.

TBC Care Product

Entity Care℠ provides services to evaluate, identify and consult on the best way to manage a business.

TBC Services

The Strategic Business Advisory Services are focused on helping small business clients start and grow their ventures, develop net worth and the retain or transfer their accumulated wealth.

TBC Care Product

Legacy Care℠ provides personal + financial services to assure individuals receive the care they desire for themselves, loved ones, and charitable organizations.

Business Advisory Articles

Do you know what your business is worth? Knowledge of value may be required for multiple reasons which include exit, sale of business, estate, divorce and tax basis.

This is the fourth part of the Planning Your Exit series in which this article focuses on Business Exit Finances.

This is the third part of the Planning Your Exit series in which this article focuses on exiting through Sale of Business To an Outsider.

This is the second part of the Planning Your Exit series in which this article focuses on exiting by Transferring Ownership or Selling Internally.

The primary purpose of an exit plan is to optimize the value of the business at the time of exit, minimize the amount of taxes to be paid, and ensure that the defined personal and financial goals of the owner can be accomplished.

Completion of these 7 tasks best assures successful business plan usage.

To the entrepreneur, business can be viewed as a serious and rewarding game. With a defined game, strategy, team, manager, and overachieving, success will come to those who play the game to win.

The basics of small business growth are often overlooked. It begins with the vision, skills and energies of an entrepreneur. Over time, it evolves. A concept slowly develops into a vibrant venture with its own life.

No entrepreneurial process is more important than identifying, tracking and acting upon the critical few. Prioritize three to four actions that are most important to focus on.

A business review makes possible the evaluation of the performance of a business and provides the basis for course corrections that align a business to its vision. Does your business need a routine review?

💬 Have questions?

To make an appointment with our Business Advisory Team, we invite you to contact our office today!