Business Valuation: What Is My Business Worth?

Introduction

For purposes of formally defining the value of a business or professional practice, Fair Market Value is defined as the expected price at which the business will change ownership between a willing buyer and a willing seller. Knowledge of value may be required for multiple reasons which include exit, sale of business, estate, divorce and tax basis. In determining valuations, neither the buyer nor the seller is to be under any conflicting interest to complete a financial transaction. Both buyer and seller are to have full knowledge of the relevant facts.

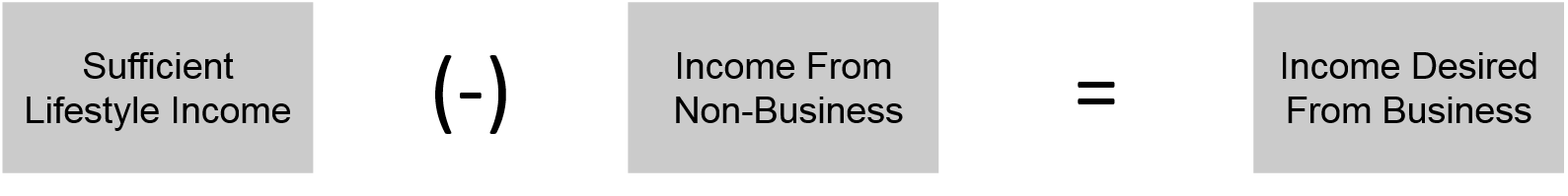

Most small business owners, exiting in a manner that provides sufficient lifestyle income is essential to long-term success. Simply defined:

A combination of data defining economic conditions, investment rates, comparable business performance and firm performance with an emphasis on the measurement and analysis of financial parameters are all relevant in evaluating the business worth.

Business Value

Business or Enterprise Value includes tangible or fixed assets of inventory, furniture, fixtures and equipment plus all intangible assets as goodwill, patents and trade marks. Net Value typically excludes cash, cash equivalents, accounts receivable, non operating assets and all business liabilities. All or some of the elements of value may be offered to a potential buyer with each alternative providing a different valuation which can then be expressed as a sales price if the transaction being considered is a sale of the business.

There are three fundamental approaches to determine the value of a business or professional practice: Asset, Market and Income. Since there is more than one process of each of the three, a limited number of 20 or more approaches can be applied to determine the worth of a business. In so doing, each process will have an end result which further would be a weighted average worth.

Recommendation

Because of the complexity and associated cost, Total Business Care recommends a small business owner evaluate the level of detail offered in each of three types:

Estimated Value

Is most often a simply documented “Rule of Thumb” and a quick “Comparison to Market”. This is the least detailed type. Quick response and minimum cost by a knowledgeable financial professional are typical requirements.

Calculated Value

Is an in-depth and detailed documentation of the methods that are used to develop an Estimated Value plus a more sophisticated method such as the commonly applied method of “Multiple of Earnings”.

Appraised Value

Is per the requirements of the International Valuation Standards Council by a Certified Professional Appraiser who typically applies all three valuation approaches of Assets, Market and Income. Valuation costs can be significant.

Summary

In Exit transactions in which the sale of business is typically involved, determination of the value of your business is a place to start. Because terms and conditions of sale vary widely; obtaining both Calculated Value and transactional support as provided by a professional general management and financial services firm like Total Business Care is recommended.

Have any questions or want to learn more? Call us at (510) 797-8375 or send us an email to request more information.

Contributor

Total Business Care, LLC

Staff