Planning Your Exit Part 4: Business Exit Finances

“Desired income after exit from your business, as made up of direct income from your business or indirectly from the assets of your business, must be sufficient when added to income generated from other sources to provide the lifestyle you desire.”

The three essential questions a business owner should address when planning their exit is:

1. How much income will give me the lifestyle I desire in the future?

2. When do I want to leave my business?

3. How do I wish to leave my business?

In answering the question, “How much income?” the definition of lifestyle income by Robert A. Unstick, is applicable.

This definition is relatively simple, but the calculations are not. You will probably require the services of one of the members of the TBC Exit Team to help you determine your exit income gap, if any.

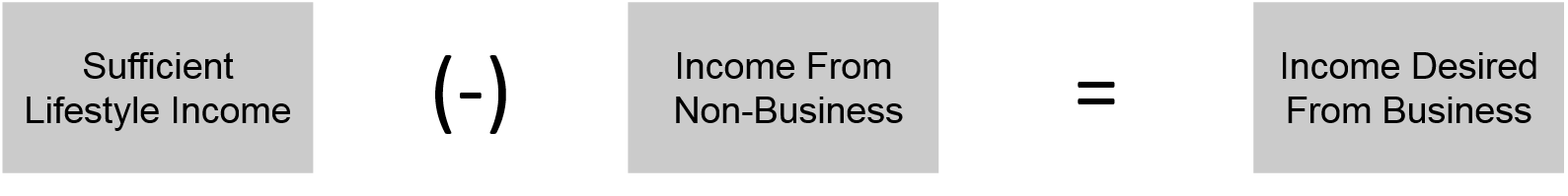

Pictorially the relationships of Lifestyle, Non-Business and Business Income are as follows:

Ideally, your requirement for business related income is zero as calculated per this definition. When zero, this condition provides considerable flexibility in planning the “When” and “How” of your Exit.

An amount greater than zero defines a planning need or gap that is best reduced before exit through completion of one of more well-defined action plans.

Reduction Alternatives

Actions to reduce your gap best include one or more of the following:

Formal Plans. Business and Personal Financial Plans plus Reviews are priorities.

Increased Value. Focus on specific means allows an increased selling price.

Extended Date. Continuing beyond your desired exit date reduces future needs.

Tax Favored. An entity change and a 401K potentially reduce income tax liabilities.

Roth Plans. A Roth 401(k) and a Roth increase personal net income without taxes.

Lease Backs. Real Estate and intellectual property can provide separate income.

This is the fourth part of a series of articles on Exit Planning. Future blogs in this series will focus on Business Valuation.

Have any questions or want to learn more? Call us at (510) 797-8375 or send us an email to request more information.

CONTRIBUTOR

Bob Morris

Certified Management Consultant, One Page Planner, Succession Planning, Teacher